If you’re starting to think about Medicare, you probably already have a feeling that the process can be, well, anything but simple. One way to lighten the load is to find an insurance group that makes the whole experience feel easier and more human. Another huge help is knowing what common slip-ups to watch out for along the way. Let’s talk about those mistakes so you can sidestep them with confidence.

Missing Your Enrollment Window

This one is a big deal. When you first become eligible for Medicare, you get a 7-month window to sign up. This is your Initial Enrollment Period. It includes the three months before your 65th birthday month, your birthday month itself, and the three months after.

If you miss this window and don’t have other qualifying health coverage (like from an employer), you could face a late enrollment penalty. And this isn’t a one-time thing; it’s a fee that gets added to your Part B premium for as long as you have the coverage. Starting off your retirement by paying more for the same thing is something we can all agree is best to avoid.

Assuming Medicare Covers Everything for Free

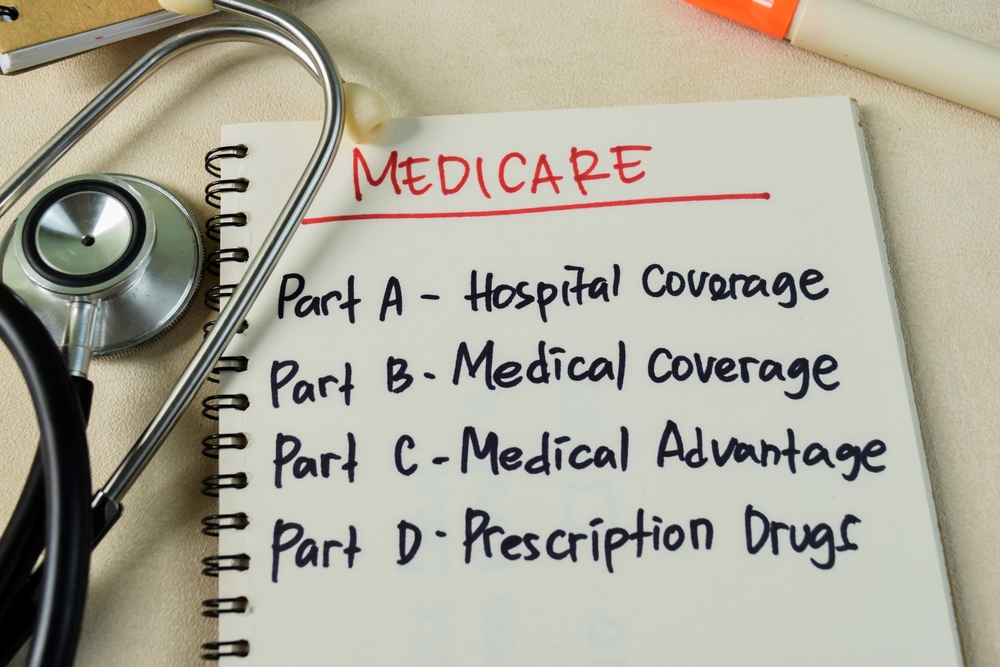

Many people think that once you have Medicare, all your health costs are covered. The reality is a little different. While Part A (Hospital Insurance) is often premium-free for most people, other parts have costs you should plan for in your personal finance budget.

You’ll have a monthly premium for Part B (Medical Insurance), and this amount can change based on your income. Plus, both Part A and Part B have a deductible you’ll need to pay before your coverage kicks in. After that, you’re usually responsible for about 20% of the cost for most doctor services and outpatient care. These gaps are where a lot of unexpected bills can pop up.

Confusing Medigap With Medicare Advantage

This is probably one of the most common points of confusion, and it’s a big one because these two options work in completely different ways.

A Medigap policy, also called a Medicare Supplement, works with Original Medicare (Part A and Part B). It’s a separate insurance policy you buy from a private company that helps fill in the “gaps,” like paying for your deductible and the 20% coinsurance. With Medigap, you keep using your red, white, and blue Medicare card, and you can see any doctor in the country who accepts Medicare.

Medicare Advantage Plans (sometimes called Part C) are an alternative to Original Medicare. You get your health and drug coverage all bundled together into one policy from a private company. These plans often have networks, like an HMO or PPO, which means you may need to use specific doctors and hospitals. While they can offer extra perks like dental and vision, it’s a completely different way to receive your Medicare benefits. Knowing the medicare advantage eligibility requirements is the first step in this direction.

Forgetting About Prescription Drugs

Original Medicare doesn’t cover most prescription drugs you take at home. For that, you need a Medicare Part D plan. This is a standalone drug policy you add on. If you don’t sign up for a Part D plan when you’re first eligible and you don’t have other good drug coverage, you could get hit with another lifelong late enrollment penalty if you decide you need one later.

Even if you don’t take many medications right now, getting a low-premium drug plan can protect your health and your finances down the road. You can always re-evaluate your policy during the annual enrollment period to find one that better fits your needs.

Thinking You’re Automatically Signed Up

This is a tricky one. You are only automatically enrolled in Medicare Parts A and B if you’re already getting Social Security or Railroad Retirement Board benefits for at least 4 months before you turn 65.

If you’re still working or have chosen to delay your Social Security benefits, you will need to actively sign up for Medicare yourself. Don’t wait for a card to show up in the mail. You have to take action to get the health insurance information and get the process started.

Get a Human Touch for Your Medicare Journey

Thinking about enrollment windows, deductibles, and the differences between Medigap and Medicare Advantage plans can make anyone’s head spin. This new chapter in your life should be about your retirement and your health, not about feeling lost in a pile of paperwork.

At Core Value Insurance Group, we bring a human element to the process. We believe getting your Medicare set up shouldn’t feel like a test you have to pass. We put your peace of mind first, offering support with compassion. Let’s make this easier, together.

Book with CVIG today and get the support you deserve.

Medicare Parts

Speak with a licensed insurance agent!