Turning 65 is a major milestone. For many people, it means new adventures and a well-earned chapter of life. It also means you’re eligible for new insurance coverage. If you’re becoming eligible for Medicare, whether because you’re approaching your 65th birthday or qualifying due to a disability, it can also bring a mix of relief and uncertainty.

On one hand, there’s comfort in knowing you’ll have health coverage in place. On the other, there’s often confusion. Suddenly, your mailbox fills with brochures. Television commercials talk about benefits and deadlines. Friends and neighbors share advice that sometimes conflicts. And everywhere you turn, you’re hearing unfamiliar terms like Part A, Part B, Part C, Part D, deductibles, premiums, and formularies.

Fortunately, Medicare doesn’t have to feel like a puzzle you’re trying to solve by yourself. With the right guidance and a clear understanding of your options, you can make informed decisions with confidence. At Core Value Insurance Group (CVIG), our licensed professionals are dedicated to helping individuals understand Medicare in plain language and enroll in coverage that truly fits their needs.

To get started, take a look at our guide to Medicare for first-time enrollees.

When and How You Become Eligible for Medicare

Most people become eligible for Medicare when they turn 65. However, eligibility can occur earlier if you:

- Have received Social Security Disability Insurance (SSDI) benefits for 24 months

- Have Amyotrophic Lateral Sclerosis (ALS)

- Have End-Stage Renal Disease (ESRD)

The Initial Enrollment Period (IEP)

For most first-time enrollees, Medicare begins with the Initial Enrollment Period (IEP). This is a seven-month window that includes:

- Three months before your 65th birthday month

- The month of your birthday

- Three months after your birthday month

This period is extremely important. Enrolling during your IEP helps ensure your coverage starts on time and helps you avoid potential late enrollment penalties.

The General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, you may need to wait for the General Enrollment Period, which runs from January 1 to March 31 each year. Coverage typically begins later in the year, and you could face permanent late enrollment penalties, particularly for Part B and Part D.

Special Enrollment Periods (SEPs)

Some individuals qualify for a Special Enrollment Period. This enrollment period is for MAPD (which stands for Medicare Advantage Prescription Drug plan). This is a bundled private insurance plan combining Original Medicare (Parts A & B) with Medicare Part D drug coverage.

Timing truly matters with Medicare. Missing deadlines can result in higher monthly premiums or gaps in coverage. Understanding your enrollment period is one of the first and most important steps in your Medicare journey.

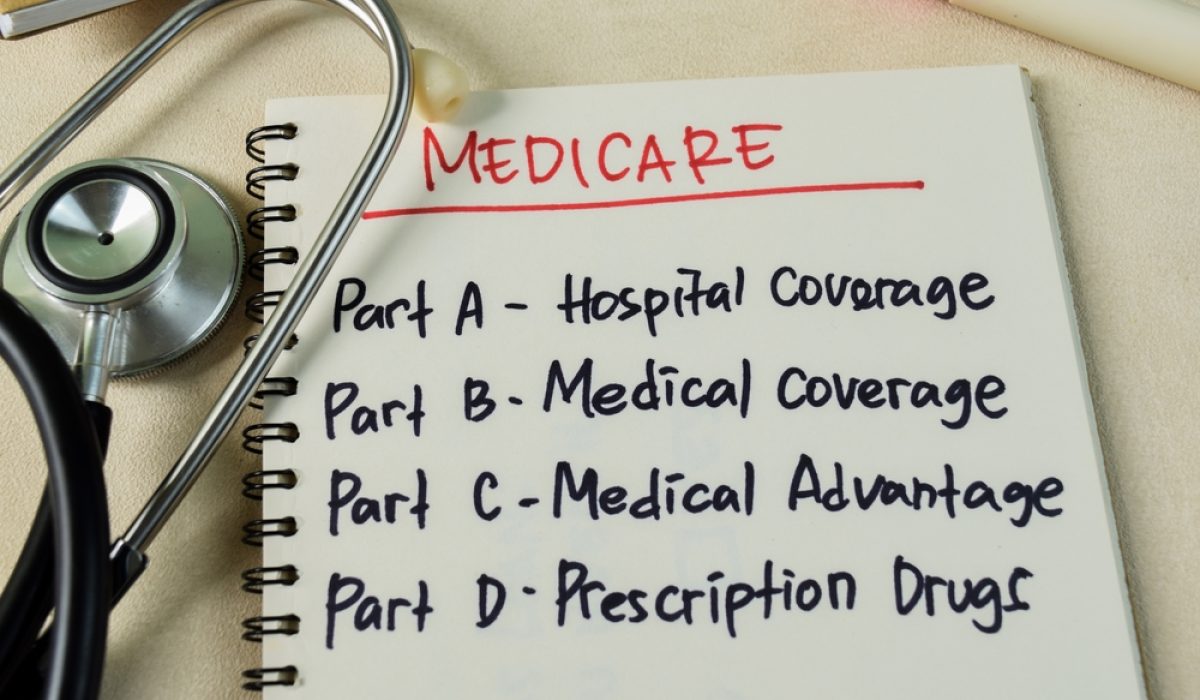

Understanding the Different Parts of Medicare

Medicare is divided into several parts, each covering different types of healthcare services. Let’s simplify what each one does.

Medicare Part A — Hospital Insurance

Part A generally covers:

- Inpatient hospital stays

- Skilled nursing facility care (after a qualifying hospital stay)

- Hospice care

- Some home health services

Most people do not pay a premium for Part A if they’ve worked and paid Medicare taxes for at least 10 years (40 quarters). However, there are deductibles and cost-sharing amounts for hospital stays.

Medicare Part B — Medical Insurance

Part B covers outpatient medical services, including:

- Doctor visits

- Preventive services

- Lab tests and diagnostic imaging

- Durable medical equipment

- Some home health services

Unlike Part A, most people pay a monthly premium for Part B. There is also an annual deductible and typically a 20% coinsurance for covered services.

Medicare Part C — Medicare Advantage

Medicare Advantage plans are offered by private insurance companies approved by Medicare. These plans:

- Include all benefits of Part A and Part B

- Often include prescription drug coverage (Part D)

- May offer additional benefits like dental, vision, or hearing coverage

Coverage is delivered through a private insurance plan rather than directly through the federal government.

Medicare Part D — Prescription Drug Coverage

Part D helps cover prescription medications. These plans are also offered by private insurance companies and work alongside Original Medicare or as part of many Medicare Advantage plans.

Each Part D plan has its own list of covered drugs, known as a formulary, as well as specific cost structures.

Original Medicare vs. Medicare Advantage: What’s the Difference?

Once you enroll in Parts A and B (Original Medicare), you’ll need to decide how you want to receive your benefits.

With Original Medicare:

- You can visit any doctor or hospital nationwide that accepts Medicare.

- There are no network restrictions.

- You typically pay 20% of covered services after the deductible.

- You may add a standalone Part D plan for prescriptions.

- You may purchase a Medigap plan for additional cost protection.

With Medicare Advantage:

- Coverage is provided through a private insurance company.

- Plans may have network requirements (HMO or PPO).

- Many plans include prescription drug coverage.

- Some plans offer extra benefits not covered by Original Medicare.

The trade-off often comes down to flexibility versus bundled convenience. Original Medicare provides broad provider access, while Medicare Advantage may offer lower upfront premiums and added benefits, but with network considerations.

Neither option is universally “better.” It depends on your health needs, travel habits, prescription medications, and personal preferences.

Do You Need a Medicare Supplement (Medigap) Plan?

If you choose Original Medicare, you may want to consider a Medicare Supplement (Medigap) plan.

Medigap plans are designed to help cover out-of-pocket costs that Original Medicare doesn’t fully pay for, such as:

- Deductibles

- Coinsurance

- Copayments

For example, under Original Medicare, you’re typically responsible for 20% of approved outpatient services. If you undergo an expensive procedure, that 20% could add up quickly. A Medigap plan can significantly reduce or eliminate that cost, depending on the plan selected.

Medigap plans are standardized and labeled by letters (such as Plan G or Plan N). While benefits are standardized, premiums may vary by company.

Your six-month Medigap Open Enrollment Period begins when you’re 65 and enrolled in Part B. During this window, you generally cannot be denied coverage due to health conditions.

Prescription Drug Coverage: What First-Time Enrollees Should Know

Even if you don’t currently take many medications, enrolling in Part D when you’re first eligible is often important.

Why? Because Medicare imposes a late enrollment penalty if you go without creditable prescription drug coverage for too long. This penalty is added to your monthly premium and can last for as long as you have Part D coverage.

Each Part D plan has:

- A formulary (list of covered medications)

- Tiers that affect pricing

- Preferred pharmacy networks

When evaluating plans, it’s essential to check that your specific medications are covered and to compare estimated annual costs, not just the monthly premium.

Common Mistakes First-Time Medicare Enrollees Make

Since Medicare decisions are complicated, mistakes are common, especially when a person doesn’t seek expert guidance. Some typical pitfalls include:

- Missing enrollment deadlines and facing penalties

- Assuming Medicare covers everything

- Ignoring prescription drug coverage

- Failing to review provider networks

- Choosing a plan based solely on premium cost

- Not reviewing coverage annually

The most successful enrollees are those who ask questions and review their choices carefully.

How Core Value Insurance Group Helps First-Time Medicare Enrollees

At Core Value Insurance Group (CVIG), our licensed professionals focus on education first. We take the time to:

- Review your healthcare needs and priorities

- Explain Medicare Parts A, B, C, and D clearly

- Compare available plan options

- Evaluate prescription coverage

- Help you understand costs and timelines

- Assist with enrollment paperwork

We believe every individual deserves to understand their coverage and feel confident in their decision. After all, Medicare isn’t just about insurance; it’s about protecting your health, your finances, and your peace of mind.

And our support doesn’t stop after enrollment. As your needs change, we’re here to help review your coverage and answer questions year after year.

Start Your Medicare Journey With Confidence

If you’re approaching Medicare eligibility, or if you’ve recently become eligible and aren’t sure what to do next, reach out to Core Value Insurance Group to speak with a licensed Medicare professional who can answer your questions, explain your options, and help you enroll with confidence and peace of mind.

You deserve clarity. You deserve answers. And most of all, you deserve coverage that fits your life. Let’s make sure you start your Medicare journey the right way.